Are you dreaming of upgrading your living space but feeling overwhelmed by the financing options? Navigating the world of home improvement loans and financing can feel like a maze, but understanding your choices is the first step towards transforming your house into the home of your dreams.

The aspiration to enhance one's living environment is a universal one. Whether its a kitchen remodel, a bathroom upgrade, or a complete overhaul of the living space, home improvement projects can significantly elevate the quality of life. However, the costs associated with these projects can be substantial, often requiring homeowners to explore various financing avenues. This article delves into the diverse options available to fund home improvements, from traditional loans to innovative grants, offering a comprehensive guide to help you make informed decisions.

Homeowners today are presented with a multitude of financing solutions, each designed to cater to different financial situations and project scopes. A well-considered approach involves not only understanding the various types of loans but also assessing personal financial circumstances, risk tolerance, and long-term financial goals. The choices available today are vast, ranging from options that require collateral to those that do not, and from fixed interest rates to variable ones. Choosing the right fit can be a complex task.

One of the initial considerations for many homeowners is the potential use of a home equity line of credit (HELOC). It provides a homeowner the opportunity to borrow against the equity built up in their home. The interest rate on a HELOC can fluctuate based on market conditions, making it a variable-rate option. For instance, getting a rate lock of 5.25% on a $50,000 portion of a home equity line of credit can result in monthly principal and interest payments of $300. This highlights the importance of careful planning, as well as keeping a close eye on prevailing interest rates.

However, HELOCs are not the only route. Home improvement loans are a dedicated option specifically tailored for renovations and upgrades. These loans can finance a variety of projects, from minor repairs to extensive remodeling projects. The appeal lies in their flexibility and the capacity to address specific home improvement needs.

A significant advantage of home improvement loans is their ability to cover a broad range of projects, enabling homeowners to finance everything from kitchen and bathroom renovations to landscaping and energy-efficient upgrades. Moreover, unlike some other financing options, such as refinancing your mortgage, home improvement loans often offer a straightforward and dedicated route to funding these projects.

- Stray Kids Skz Members Age Order Birthdays From Oldest To Youngest

- Perfect Medium Well Steak Guide To Temp Doneness

In addition to the more standard approaches, homeowners can also explore options such as refinancing their mortgage to include cash-out, essentially leveraging the equity in their home to finance improvements. This strategy allows homeowners to convert some of their home equity into ready cash to undertake necessary or desired projects.

Home improvement is not merely about the physical upgrades, it can also be an empowering experience. The ability to personalize and improve one's living space often leads to an increased sense of pride and satisfaction. The process of choosing materials, working with contractors, and seeing the final result can be deeply rewarding.

To guide homeowners through the process, many lenders provide tools and resources, like home improvement loan calculators, to estimate the total project cost. These tools factor in elements like the project budget and the anticipated interest rate, providing a clearer picture of the financial implications.

Once the estimated project cost is understood, the next decision involves selecting the right financing method. Homeowners should carefully weigh the pros and cons of each option, taking into account factors such as interest rates, repayment terms, and the overall impact on their financial situation. Options like personal loans, home remodel loans, and home repair loans all have specific features that might make them suitable for certain circumstances.

For those considering personal loans, it's crucial to conduct comprehensive research. Understanding the terms, conditions, and eligibility criteria of each loan is crucial. This could include exploring lenders like SoFi, which offer personal loans ranging from $5,000 to $100,000 with repayment terms spanning two to seven years, or examining offerings from PNC Bank that provide personal home improvement loans from $1,000 to $35,000.

The world of home improvement loans also has its own set of regulations and standards. All home lending products are, for instance, subject to credit and property approval. This means a lender will assess an applicant's creditworthiness and the value of the property. Furthermore, the interest rate and terms can change without notice, underscoring the importance of keeping abreast of current conditions.

Home equity loans stand as a notable example of fixed-rate financing. The fixed nature of these loans implies consistent monthly payments throughout the loan term, providing predictability and stability. Home equity loans typically offer a lump sum that can be used for various purposes, including home improvements.

It is critical to compare various loan offerings and their terms. Home improvement loan rates can currently range from about 7 percent to about 36 percent, signifying the impact of creditworthiness and market conditions on the cost of borrowing.

Government grants also provide financial relief for home improvement projects. These grants are intended to provide financial aid to homeowners for various types of home improvement and are a significant avenue that needs to be explored.

Whether homeowners are exploring home equity loans, home improvement loans, or government grants, the process necessitates an informed approach. It requires research, comparison, and a clear understanding of the financial implications.

Home improvement loans often range from $1,000 to $100,000. The actual amount you qualify for will depend on factors like credit score, income, and the value of the home. Contacting a home lending advisor provides access to detailed and tailored information.

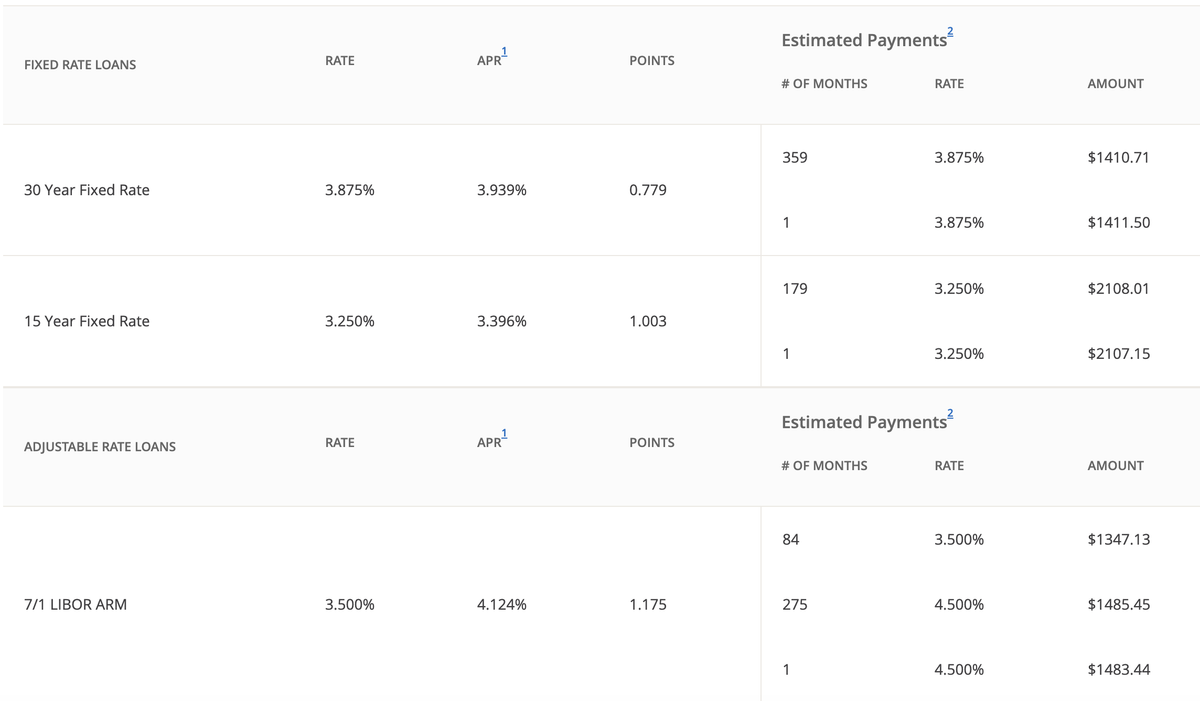

The Annual Percentage Rate (APR) is another crucial detail to understand. The APR is the cost of credit over the loan's term expressed as an annual rate, and it is based on elements like interest rates, any points, and mortgage insurance. APRs can also vary and may increase after the loan closes. Borrowers with lower credit scores might encounter higher interest rates.

Additionally, the type of loan influences the interest rate. Adjustable-rate mortgages (ARMs) initially have fixed rates that change after a set period. Understanding these nuances is important when comparing various financing options.

Home improvement projects, especially large ones, often require substantial financial investment. Several factors can influence the cost of home improvement loans, including the loan amount, the borrower's creditworthiness, and the prevailing interest rates.

Some lenders provide homebuyer grants, such as the Chase Homebuyer Grant, which can provide financial support at closing. These grants, available in specific areas, can significantly help offset the upfront costs associated with homeownership.

In the context of home financing, the "occupancy type" refers to how the property will be used. The loan terms might vary based on the occupancy type. Reviewing current mortgage rates, tools, and articles is also a crucial part of the research process.

Several financial institutions offer home improvement loan products. For example, PNC features personal home improvement loans on their website. These loans often have set installment plans with fixed interest rates. SoFi offers loans ranging from $5,000 to $100,000 with varying repayment terms. Furthermore, PNB Housing provides home loans with floating interest rates.

For instance, in October 2020, Chase Bank had an A+ rating with the Better Business Bureau, although online reviews were varied. This illustrates how different factors like credit ratings, income, and the value of the property affect a borrower's eligibility for home improvement loans.

The process of finding the right home improvement loan involves careful comparison of rates, terms, and conditions. The aim is to secure the most cost-effective financing option that meets your requirements. This includes looking into APR, loan amounts, and various lending options like HELOCs, home equity loans, and personal loans.

Detail Author:

- Name : Mrs. Holly Grant

- Username : cgislason

- Email : dominique.corwin@macejkovic.info

- Birthdate : 1993-10-31

- Address : 51432 Schowalter Drives Conroyfurt, CT 83275

- Phone : 872.862.7052

- Company : Ratke LLC

- Job : First-Line Supervisor-Manager of Landscaping, Lawn Service, and Groundskeeping Worker

- Bio : Dolore qui illo dolores aut aut consectetur laboriosam perspiciatis. Quis molestiae aut ratione voluptate delectus ab voluptate. Rerum optio et repudiandae rem. Minus porro ab illo tempore non fugit.

Socials

instagram:

- url : https://instagram.com/charlie.dubuque

- username : charlie.dubuque

- bio : Culpa et soluta velit non vitae animi exercitationem. Sed consequatur dignissimos ratione ut et.

- followers : 1943

- following : 2412

tiktok:

- url : https://tiktok.com/@charlie_real

- username : charlie_real

- bio : Voluptas rerum id et alias.

- followers : 1573

- following : 1381

twitter:

- url : https://twitter.com/charliedubuque

- username : charliedubuque

- bio : Voluptas delectus sed ea at. Officiis consequatur id in rerum rerum. Sint at quis commodi sunt repellat quisquam.

- followers : 4403

- following : 2575