Are you pondering the possibilities of refinancing your home mortgage? Securing a lower interest rate on your existing mortgage can translate to significant savings over the life of your loan, potentially freeing up funds for other financial goals or simply providing more breathing room in your monthly budget.

The realm of mortgage refinancing presents a dynamic landscape, influenced by fluctuating interest rates, individual financial circumstances, and long-term financial aspirations. For homeowners, it's a critical financial undertaking, warranting careful consideration and a thorough understanding of the available options.

Here's a look at the main aspects of Mortgage Refinance:

- Boost Creativity With Wewillwrite A Guide For Students Educators

- Delucas Tragic Greys Anatomy Journey Death A Recap

| Aspect | Details |

|---|---|

| Definition | Replacing an existing mortgage with a new one, typically to secure a lower interest rate, change loan terms, or access home equity. |

| Reasons to Refinance |

|

| Types of Refinance |

|

| Eligibility Requirements |

|

| Costs Involved |

|

| Decision-Making Factors |

|

| Process |

|

| Potential Benefits |

|

| Potential Risks |

|

| When to Refinance |

|

For those contemplating a mortgage refinance, exploring the current offerings from institutions like Chase can be a prudent first step. Chase offers competitive mortgage refinance rates, providing a range of options designed to align with diverse financial goals and circumstances. The potential benefits can be substantial, including lower monthly payments, the ability to pay off a loan more quickly, or the option to tap into the equity built up in a home for various financial needs.

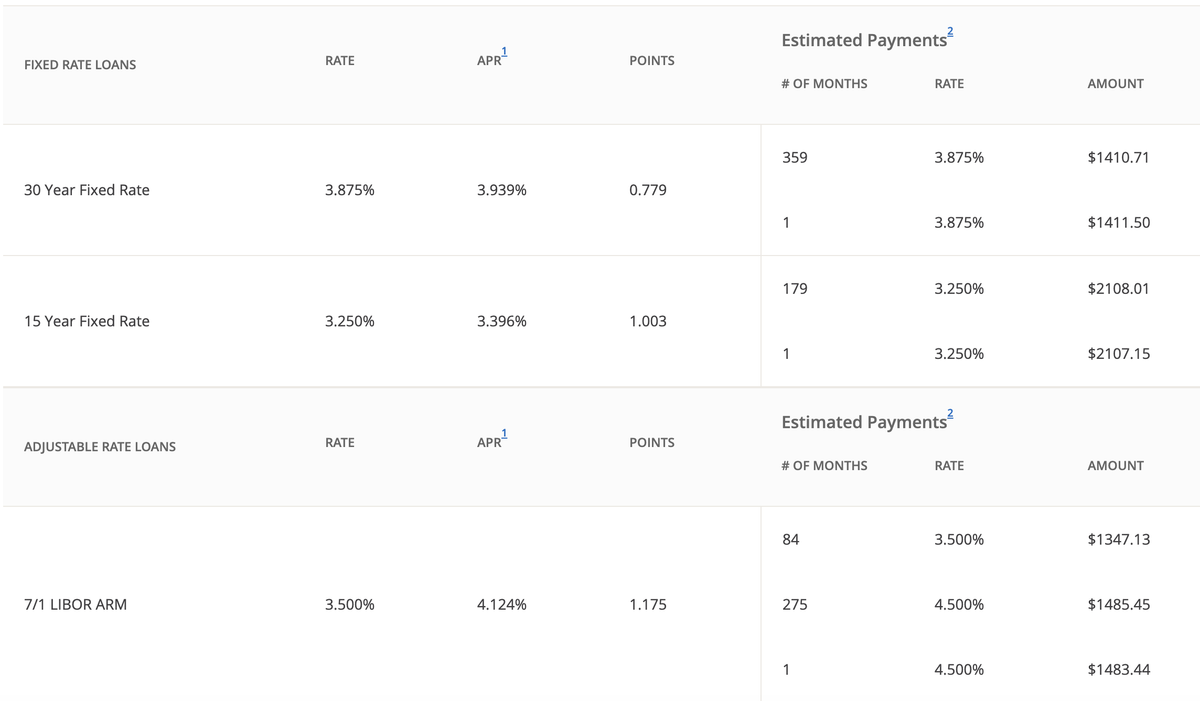

The process begins with understanding the current market conditions. Chase's website, and those of other lenders, typically feature readily accessible information on current refinance rates. These rates are often displayed with sample Annual Percentage Rates (APRs), making it easier to compare options based on individual circumstances and zip codes. It is important to consider the cost of refinancing.

Many homeowners consider a refinance if the new interest rate is at least 1% lower than their existing rate. While this rule of thumb can be a good starting point, it's essential to evaluate the breakeven point the time it takes for the savings from the lower monthly payments to offset the closing costs associated with the refinance. This involves calculating the total closing costs and dividing that amount by the monthly savings to determine how many months it will take to recoup those costs. Only then can the true financial impact of refinancing be accurately assessed.

Beyond simply lowering monthly payments, refinancing can serve other vital purposes. It can be a tool to access the equity in a home, providing a source of funds for home improvements, debt consolidation, or other major expenses. This approach, often referred to as a cash-out refinance, allows homeowners to borrow more than the remaining balance of their existing mortgage, receiving the difference in cash. The availability of cash through refinancing can provide financial flexibility.

Refinancing can also play a role in adapting to the changing financial landscape. Perhaps you're considering refinancing your mortgage to take advantage of lower interest rates, potentially reducing your monthly payments and saving money over the long term. By refinancing, you replace your original mortgage with a new one that has a lower interest rate, which can lead to substantial savings.

In March 2023, the APRs on Chase loans varied. The financial institution's website features a page dedicated to current home refinance rates that conveniently displays sample annual percentage rates (aprs) for a variety of its loans based on your zip code.

Chase offers a wide range of home loan products with annual percentage rates (aprs) that tend to be lower than the market average. They also lend jumbo, FHA, VA, and Dreamaker mortgages. Its worth noting that Chase offers several appealing home buyer programs, including loans with 3% down payment requirements, homebuyer assistance grants, and a payout for delayed closings.

The financial institution's website features a page dedicated to current home refinance rates that conveniently displays sample annual percentage rates (APRs) for a variety of its loans based on your zip code. It's possible to start the application process for a mortgage online, after which Chase will provide you with a loan.

The process is straightforward. First, understand the available options: "Refinance your existing mortgage to lower your monthly payments, pay off your loan sooner, or access cash for a large purchase. You can also "use our home value estimator to estimate the current value of your home" and then "see our current refinance rates and compare refinance options."

Considering the benefits of refinancing is essential, securing lower mortgage refinance rates is a key advantage. When interest rates are lower, you may be able to refinance your loan and lower your monthly mortgage payments. The most common reason for refinancing is to lower your interest rate, which happens when current mortgage rates are lower than your current rate. Traditionally, many people tend to refinance if the new rate is at least 1% lower than their current rate. Always "check out today's refinance rates to compare them to your current mortgage rate."

Remember that in the realm of real estate transactions, closing fees are standard. Regardless of the type of refinance, it's likely that you'll owe closing costs.

For those seeking to refinance, the allure of securing competitive interest rates is a significant draw, and one of the most alluring aspects of Chase Bank's mortgage refinance loans are the competitive interest rates they offer. However, a comprehensive review extends beyond interest rates. You will need to "take into account the cost of refinancing."

A thorough evaluation of the terms and conditions associated with a refinance is essential. Understanding the various mortgage refinancing options available and learning more about the specifics, including the terms and interest rates, can empower you to make an informed decision. Considering the benefits of refinancing is crucial, securing lower mortgage refinance rates is a key advantage.

The decision to refinance also hinges on individual risk tolerance. Some borrowers prioritize certainty, preferring to "lock in a set rate for the life of your loan." This eliminates the uncertainty of fluctuating rates. Whether you are considering this due to the fact that "perhaps you think rates cant get much lower," or because you "dont want the uncertainty of changing rates," Chase offers several appealing home buyer programs, including loans with 3% down payment requirements, homebuyer assistance grants, and a payout for delayed closings.

The possibility of refinancing, especially if interest rates are lower, is a key consideration. It's also a moment to explore the available options to pay off the loan sooner, or to access cash for a large purchase, as well as to compare refinance options.

One of the most important factors in refinancing is comparing current interest rates to the interest rates of your original (current) mortgage loan.If today's interest rates are lower, you could save money over the course of your loan.

Chase provides essential tools and resources to help homeowners make informed decisions. These include a home value estimator to gauge the current value of a property, making the mortgage or refinance applications straightforward. The availability of tools like mortgage calculators is helpful.

Ultimately, the path to a successful mortgage refinance hinges on careful planning, diligent research, and an understanding of the available options. Whether it's lowering monthly payments, paying off a loan sooner, or accessing cash, refinancing can be a powerful tool in managing a homeowner's financial portfolio. Chase, and other lenders, offer a gateway to a potentially brighter financial future for many homeowners. However, it is always recommended to check the terms and conditions of the loan.

Detail Author:

- Name : Betsy Murazik IV

- Username : dagmar24

- Email : fae.mohr@kuhic.com

- Birthdate : 1981-02-21

- Address : 8896 Scarlett Corners Apt. 724 East Shayna, NJ 79122

- Phone : (458) 724-4694

- Company : Maggio-Volkman

- Job : Textile Cutting Machine Operator

- Bio : Quia maxime animi qui. Animi consequatur nostrum qui repellendus.

Socials

instagram:

- url : https://instagram.com/arnold_schuppe

- username : arnold_schuppe

- bio : Qui et aut et culpa sint sint voluptatem. Accusamus aut illo esse aut voluptatem et iusto.

- followers : 4747

- following : 1486

facebook:

- url : https://facebook.com/arnold_schuppe

- username : arnold_schuppe

- bio : Rem ut voluptates dolorem. Sed quia et qui et in eius.

- followers : 1645

- following : 1450

linkedin:

- url : https://linkedin.com/in/arnold.schuppe

- username : arnold.schuppe

- bio : Mollitia voluptas non possimus reiciendis dicta.

- followers : 626

- following : 1312