Are Adjustable Rate Mortgages (ARMs) a smart financial move, or a potential minefield for homeowners? The allure of lower initial interest rates often masks the inherent risk of fluctuating payments, making a thorough understanding of ARMs crucial before taking the plunge.

The financial landscape is constantly shifting, and for potential homeowners, navigating the complexities of mortgage products is a critical undertaking. Among the various options available, Adjustable Rate Mortgages (ARMs) stand out as a particularly intricate choice. These loans, offered by institutions like Chase, present a unique proposition: an initial period of fixed interest rates followed by adjustments based on market conditions. While the promise of lower initial payments can be enticing, borrowers must carefully weigh the potential risks associated with fluctuating interest rates and the subsequent impact on their monthly payments.

Chase, a major player in the mortgage market, offers a variety of mortgage products, including ARMs, to potential homeowners. In addition to ARMs, Chase provides other mortgage options such as jumbo, FHA, VA, and Dreamaker mortgages. The availability of these various loan types caters to a diverse range of borrowers with varying financial situations and needs. However, ARMs, with their inherent volatility, require special attention and a deep understanding of their mechanics.

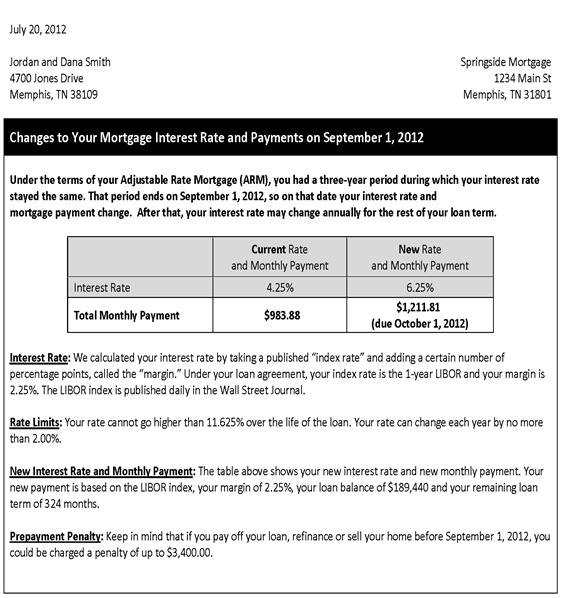

The fundamental characteristic of an ARM is its adjustable interest rate. This rate is typically fixed for an initial period, after which it adjusts periodically based on a specific index, most commonly the Libor index or the National Average Contract Mortgage Rate (NACR). This adjustment mechanism means that the interest rate, and consequently the monthly payments, can fluctuate over the loan's term. The potential for these fluctuations is a key consideration for borrowers. For instance, a 7/6 ARM might have a fixed interest rate for the first seven years, followed by adjustments every six months thereafter. This contrasts with a 7/1 ARM, which adjusts annually after the initial fixed period.

The claims in the Chase ARM class action lawsuit underscore the importance of clear and accurate disclosures. Borrowers must receive comprehensive information about the terms of their loan, including how the interest rate will adjust, the frequency of adjustments, and the maximum possible interest rate. The "Consumer Handbook on Adjustable Rate Mortgages," created to comply with federal law (12 U.S.C. 2604 and 12 CFR 1026.19(b)(1)), serves as a valuable resource in this regard. This booklet is designed to inform borrowers about the intricacies of ARMs, empowering them to make informed decisions.

JPMorgan Chase Institute data indicates that homeowners with ARMs exhibited increased spending both before and after anticipated mortgage payment decreases, even amidst declining home values. This suggests that the initial lower payments can influence consumer behavior, making it crucial for borrowers to understand the long-term implications of their mortgage choice. This highlights the need for borrowers to carefully assess their financial situation and risk tolerance before selecting an ARM.

- Unlock Creativity Explore Wewillwrite In The Classroom

- Bianca Censoris Age What You Need To Know More

The index that dictates ARM interest rate fluctuations is frequently the Libor (London Interbank Offered Rate) index. However, this particular index, and indeed the general Libor rate, has a history of volatility. It changes on a daily or even a weekly basis. Other ARMs are benchmarked against the National Average Contract Mortgage Rate (NACR) for the purchase of pre-owned homes, as measured by combined lenders. It is key to take this volatility into account.

Those considering refinancing or a home purchase will find many mortgage options through Chase. Prospective buyers can choose from a variety of products for both home purchases and mortgage refinances. It's prudent to consult a Chase Home Lending Advisor for personalized details and to explore the various options available to best suit your financial needs and circumstances.

When evaluating an ARM, consider the following factors:

- The Initial Fixed-Rate Period: How long is the introductory period with a fixed interest rate? The longer this period, the more time you have to prepare for potential rate adjustments.

- The Index: Which index is the interest rate tied to (e.g., Libor, NACR)? Research the historical performance of this index to get an idea of its volatility.

- Adjustment Frequency: How often will the interest rate adjust (e.g., annually, every six months)? More frequent adjustments can lead to more volatile payments.

- Caps: Are there caps on how much the interest rate can increase at each adjustment and over the life of the loan? Caps provide some protection against extreme rate hikes.

- Your Financial Situation: Can you comfortably afford the maximum possible payment, even if interest rates rise significantly?

- Your Time Horizon: How long do you plan to stay in the home? If you anticipate moving in a few years, an ARM might be a viable option.

Potential homeowners should contact a Chase home lending advisor for details. Additionally, information on other ARM programs is available upon request.

Heres a table summarizing some of the key aspects of ARMs offered by Chase:

| Feature | Description |

|---|---|

| Interest Rate Structure | Fixed for an initial period, then adjusts periodically based on an index (e.g., Libor, NACR). |

| Initial Fixed Period | Varies, common examples include 5/1, 7/6, or 10/1 ARMs (e.g., 7/6 means 7 years fixed, adjusts every 6 months thereafter). |

| Index Used | Often Libor or NACR; the index chosen affects volatility. |

| Adjustment Frequency | Can be annual, semi-annual, or other intervals. |

| Rate Caps | Limits on how much the interest rate can increase at each adjustment and over the life of the loan. |

| Loan Types Available | Can be used for various loan types, including jumbo, FHA, and VA mortgages. |

The presence of rate caps is critical. Caps limit how high the interest rate can rise. These caps come in two main types: periodic caps, which restrict how much the rate can change at each adjustment period, and lifetime caps, which set the maximum rate the loan can reach over its entire term. Understanding these caps is essential for managing the risks associated with ARMs.

The APR (Annual Percentage Rate) is another important consideration. The APR reflects the total cost of the loan, including the interest rate and other fees, expressed as an annual rate. The APR can increase after the loan closes. It is important to understand how this can affect the overall cost of the loan.

For those seeking to manage payments or potentially lower their interest rates, exploring options with their lender is advisable. Contacting a Chase Home Lending Advisor can help to understand the various mortgage products available and to make an informed decision based on ones financial situation.

The decision to choose an ARM involves weighing the potential for lower initial payments against the risks of future interest rate increases. The volatility of the Libor index, the adjustment frequency, and the presence of rate caps all play a crucial role in assessing the suitability of an ARM. Careful planning and a thorough understanding of the terms and conditions are crucial for navigating the intricacies of these mortgage products.

Remember that potential homeowners can choose from a variety of chase mortgage products for both home purchases and mortgage refinancing. Lock in your rate today and see how much you can save.

To further illustrate the complexities of ARMs, lets consider some hypothetical scenarios:

Scenario 1: The First-Time Homebuyer

Sarah and Mark are first-time homebuyers looking to purchase their dream home. They are considering a 5/1 ARM offered by Chase. The initial interest rate is 4.5%, significantly lower than the current fixed-rate mortgage rates. They are drawn to the lower monthly payments. However, they must carefully analyze the fine print. The loan agreement states that after the initial five-year period, the interest rate will adjust annually, tied to the one-year Libor index plus a margin. Furthermore, the loan has a periodic cap of 2% and a lifetime cap of 5%. The Libor index is currently at 2.0%.

In this scenario, Sarah and Mark must evaluate their financial stability. If the Libor index increases substantially after the initial fixed-rate period, their monthly payments could increase significantly. They should assess their ability to comfortably manage higher payments. For instance, if the Libor increases by 2% (to 4%), the interest rate on their mortgage would increase by 2% (Libor + margin), and consequently, their monthly payments would rise.

Scenario 2: The Short-Term Homeowner

John and Lisa plan to move in five years. They are looking at a 7/6 ARM. This means they have a fixed interest rate for the first seven years, and it adjusts every six months thereafter. The initial interest rate is competitive. Because they intend to move before the first adjustment, an ARM could potentially save them money compared to a fixed-rate mortgage, provided that interest rates remain stable, or do not increase dramatically during the initial seven-year fixed-rate period.

However, there are risks. If they encounter unforeseen circumstances and need to sell their home sooner, they could face financial challenges if the market has shifted and interest rates have risen. They must weigh the potential savings against the risk of higher payments if they end up staying longer than expected.

Scenario 3: Refinancing Considerations

David and Emily have an existing mortgage and are considering refinancing. They see the potential of a lower interest rate with an ARM. The key factor for them to consider is how long they plan to stay in the home after refinancing. If they plan to stay for an extended period, a fixed-rate mortgage might be more prudent to provide stability and predictability in their monthly payments. If they believe they'll move in a few years, the ARM could offer the initial lower interest rates that appeal to them.

In each of these scenarios, the ultimate decision to select an ARM hinges on individual circumstances, financial goals, risk tolerance, and the forecast for interest rates. The availability of resources like the Consumer Handbook on Adjustable Rate Mortgages is valuable for borrowers. The handbook provides an overview of important factors such as Libor, the terms, and the index to which the loan is tied, alongside the financial implications of each decision.

A central component of any ARM assessment is the selection of a benchmark or index. The Libor has been frequently used; however, it is important to remember that this has demonstrated instability, and the associated rates are subject to rapid and unpredictable adjustments. Other common indexes include the NACR. The NACR is dependent on the national average mortgage rate for existing homes as calculated by lenders. The best option here is to look for the index with the lowest volatility.

Finally, the availability of mortgage products varies. The market is always in flux and the types of products offered by Chase and other lenders, as well as the rates, are ever-changing. The best course of action to get a personalized set of information and accurate mortgage data is to reach out to a Chase Home Lending Advisor, or to visit the Chase website. They can provide you with precise details about what types of mortgages are available.

Detail Author:

- Name : Miss Amely Hudson

- Username : riley02

- Email : estel.boyle@keeling.com

- Birthdate : 2000-06-06

- Address : 166 Dickens Parkway Apt. 317 Port Rhianna, UT 01049-0794

- Phone : 657.973.9228

- Company : Johnston-Kautzer

- Job : Forensic Science Technician

- Bio : Corporis voluptates molestiae quo iste. Pariatur saepe aut id eos asperiores vel sit. Aliquid mollitia vero sed voluptates dolor earum.

Socials

linkedin:

- url : https://linkedin.com/in/vonruedena

- username : vonruedena

- bio : Ea sunt esse unde consequuntur quaerat numquam.

- followers : 3052

- following : 2801

tiktok:

- url : https://tiktok.com/@adalbertovonrueden

- username : adalbertovonrueden

- bio : Et animi quaerat vel in atque tempora qui.

- followers : 6988

- following : 21

twitter:

- url : https://twitter.com/vonruedena

- username : vonruedena

- bio : Quos mollitia temporibus odio. Dolorem suscipit similique iure est id omnis. Voluptatum recusandae aut expedita quia consequatur.

- followers : 3338

- following : 1213

instagram:

- url : https://instagram.com/adalbertovonrueden

- username : adalbertovonrueden

- bio : Molestias mollitia non cum beatae a. Rerum fugit amet commodi quia.

- followers : 883

- following : 1593