Are you seeking financial flexibility and a safety net for unexpected expenses? Personal lines of credit offer a dynamic financial tool, providing access to funds when you need them, while potentially impacting your credit score positively.

Navigating the world of personal finance can often feel like traversing a complex maze. Understanding the various options available, from traditional loans to revolving credit lines, is crucial for making informed decisions that align with your financial goals. Personal lines of credit (PLOCs) represent one such option, offering a unique blend of accessibility and adaptability. Unlike fixed-term loans, PLOCs provide a revolving source of funds that can be tapped into as needed, offering a sense of financial security and control.

This article will delve into the intricacies of personal lines of credit, exploring their features, benefits, and potential drawbacks. We will dissect how PLOCs function, how they compare to other financial products like credit cards and personal loans, and how they can influence your credit score. Furthermore, we will examine specific offerings from institutions like Chase, KeyBank, and others, providing a comprehensive overview to empower you to make the best financial choices.

- Movierulz 2025 Latest Movies Updates You Need To Know

- Steak Doneness Guide Find Your Perfect Temperature

Personal lines of credit and loans, while both serving similar purposes of providing access to funds, differ in significant ways. Personal lines of credit typically feature variable interest rates, which may fluctuate throughout the term, and are available up to a predetermined amount. These are often offered by banks, credit unions, and other financial institutions. A business line of credit shares functional similarities with a personal line of credit, as both provide a credit limit from which funds can be drawn and repaid as needed. However, interest rates for a term loan are often lower than those for a business line of credit. A business line of credit offers continuous access to funds, akin to a revolving credit arrangement, which is similar to how a personal line of credit functions. A business line of credit designates an amount of money a business can borrow, while a business credit card may have a lower credit limit, but can offer additional business specific features.

To illustrate the concept, think of a water tank with a tap you can turn on and off. A personal line of credit functions similarly; you have access to a pre-approved credit limit, and you can draw funds as needed, paying interest only on the amount you use. Just as with a credit card, your available credit decreases when you borrow funds.

Understanding the nuances of PLOCs is essential for responsible financial management. Let's explore the specifics of these credit lines, their impact on your finances, and how they can be a valuable tool for various financial needs.

Personal Line of Credit

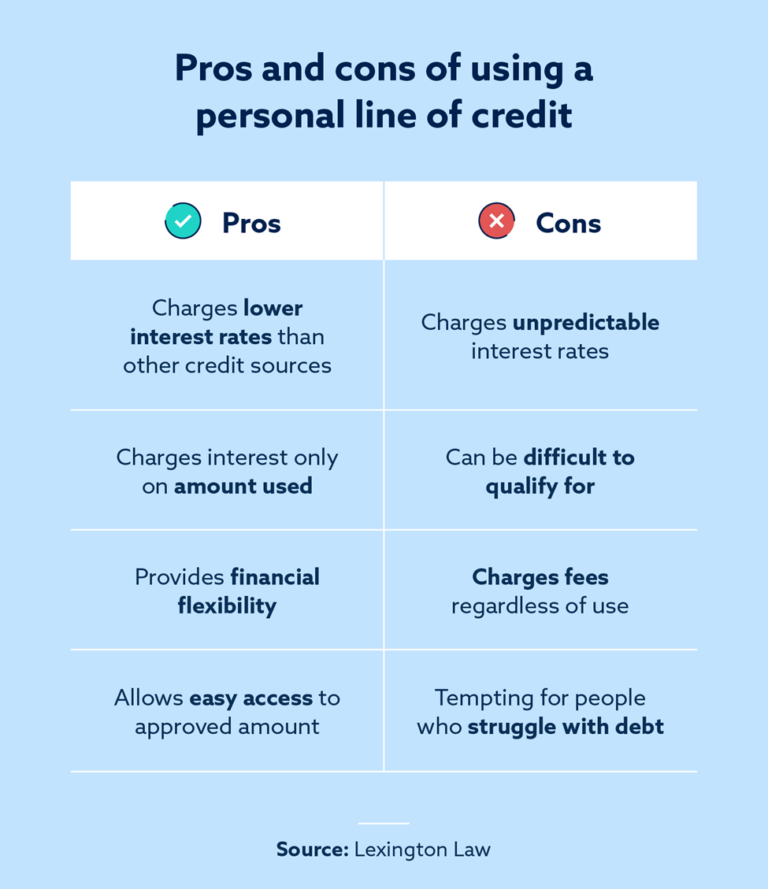

A personal line of credit (PLOC) is essentially an unsecured revolving account. This means the lender approves you for a specific credit limit, but you are not required to borrow the full amount upfront. You only draw funds when you need them, and you pay interest only on the borrowed amount. PLOCs often have a variable interest rate, meaning the rate can fluctuate over the term of the credit line, based on a benchmark rate like the Wall Street Journal Prime Rate. This makes them a flexible option for covering unexpected expenses or managing project costs.

Several financial institutions offer personal lines of credit. Banks and credit unions are common providers. These may be offered as a basic line of credit with a smaller credit amount, or as a preferred line of credit with a higher credit limit. For instance, KeyBank offers both a basic line of credit and a preferred option, with differing credit limits. Chase Bank, for example, also offers personal lines of credit to their clients.

A significant benefit of a PLOC is the ability to repeatedly borrow and repay funds, as long as you stay within your credit limit. This revolving nature allows you to access funds over and over again, providing ongoing financial flexibility. PLOCs are similar to credit cards in this respect.

Comparing PLOCs to Other Financial Products

It is important to understand how PLOCs differ from other financial products, particularly personal loans and credit cards.

- Personal Loans: Personal loans typically provide a fixed amount of money upfront with a fixed interest rate, and they have a set repayment schedule. Unlike PLOCs, you receive the entire loan amount at once, and you make regular payments until the loan is paid off.

- Credit Cards: Credit cards are also revolving credit lines, similar to PLOCs. Both offer the ability to borrow, repay, and borrow again, but the specifics differ. PLOCs sometimes offer higher credit limits and, unlike credit cards, you may be able to request an advance to your checking account.

Choosing between a PLOC, a personal loan, or a credit card depends on your individual financial needs. If you need a lump sum of cash for a specific purpose, a personal loan may be best. If you want ongoing access to funds for various expenses, a PLOC or credit card may be more suitable.

Impact on Credit Score

As with credit cards, personal lines of credit are considered revolving debt and are reported to credit bureaus. Responsible use of a PLOC can positively impact your credit score. Making payments in full and on time demonstrates responsible financial behavior and can improve your creditworthiness.

However, overutilizing a PLOC, meaning borrowing a large percentage of your available credit, can negatively affect your credit score. Credit utilization, the ratio of your outstanding debt to your available credit, is a significant factor in credit scoring models.

It is crucial to monitor your credit utilization and manage your PLOC responsibly to protect and improve your credit score. Understanding how lines of credit affect your credit score is crucial for managing your financial health.

Specifics of Chase Personal Lines of Credit

Chase Bank offers personal lines of credit to its clients. The details and terms of these PLOCs may vary depending on the individual's credit profile and financial circumstances. You can request a line of credit advance to your Chase checking account.

Loans and lines of credit from Chase are subject to credit approval. The loan terms, including the annual percentage rate (APR), may differ based on the amount borrowed, the repayment term, and your credit history. Chase may offer repayment terms for their products, such as "My Chase Loan", which allow cardholders to finance eligible purchases. These repayment terms may range from three to eighteen months, depending on the purchase amount.

Chase also offers business lines of credit, but these are distinct from personal lines of credit and are designed for business purposes. The annual fee for a Chase business line of credit, for example, is 0.25% of the credit line, with a minimum fee. However, this fee may be waived if the average utilization over the year is 40% or higher. These business credit lines have a revolving period of up to five years.

For specific details on Chase's personal line of credit offerings, it is advisable to consult their website or speak with a Chase representative. Remember that personal loan disclosures, minimum loan amounts, and APRs may vary based on individual circumstances and applicable state laws.

Portfolio Lines of Credit

A portfolio line of credit is another option, specifically designed for investors. It can provide an alternative source of liquidity, allowing an investor to avoid liquidating securities and potentially disrupting their investment strategy or triggering capital gains taxes.

This type of credit line is tailored to meet the unique needs of investors, providing them with the flexibility to manage their investments and access funds when required.

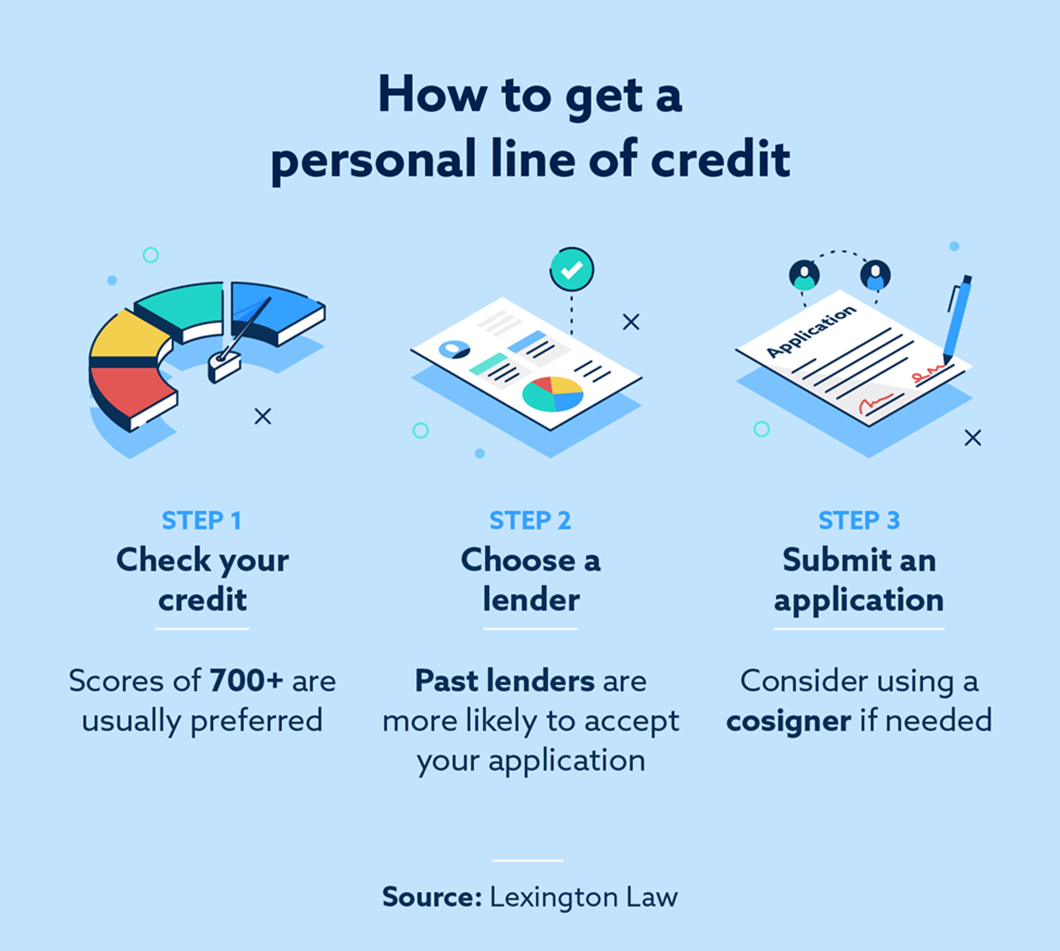

How to Apply for a Personal Line of Credit

The process of applying for a personal line of credit typically involves these steps:

- Research and Compare: Compare offers from various banks, credit unions, and online lenders. Consider interest rates, fees, credit limits, and other terms.

- Check Your Credit: Review your credit report and score to understand your creditworthiness. This will help you anticipate the interest rates you may qualify for.

- Gather Documentation: Be prepared to provide information such as proof of income, employment verification, and other financial documentation. The specific requirements will vary by lender.

- Complete the Application: Fill out the application form accurately and submit it to the lender.

- Await Approval: The lender will review your application and creditworthiness to determine whether to approve you for a PLOC.

- Review the Terms: If approved, carefully review the terms and conditions of the PLOC. Understand the interest rate, fees, repayment terms, and credit limit.

- Manage Your Credit Line: Use the PLOC responsibly, keeping track of your borrowing and repayment activity.

Your loan officer will guide you through the required documentation to expedite the approval process.

Tips for Managing a Personal Line of Credit

Effective management of a PLOC is crucial for maintaining good financial health. Here are some helpful tips:

- Monitor Your Spending: Keep track of how much you borrow and how much you repay. This will help you stay within your credit limit and avoid overspending.

- Make Payments on Time: Always pay your minimum payment or, preferably, more than the minimum payment. Timely payments help maintain a good credit score and avoid late fees.

- Keep Credit Utilization Low: Try to keep your credit utilization ratio low (the amount of credit used versus the total credit available). A low credit utilization ratio can positively impact your credit score.

- Understand Your Interest Rate: Be aware of the interest rate on your PLOC, and how it might change if it is a variable-rate line of credit.

- Avoid Overspending: Don't borrow more than you can afford to repay. Use the PLOC responsibly and only for necessary expenses.

- Review Your Statements: Regularly review your account statements to check for any errors or unauthorized charges.

By following these tips, you can effectively manage your PLOC, maximize its benefits, and mitigate any potential risks.

Conclusion

Personal lines of credit can be valuable tools for managing your finances. Understanding how they work, their benefits, and how they affect your credit is crucial. Compare offers, use credit responsibly, and stay within your credit limit. With careful management, a personal line of credit can be a powerful asset in your financial toolkit.

Detail Author:

- Name : Mrs. Holly Grant

- Username : cgislason

- Email : dominique.corwin@macejkovic.info

- Birthdate : 1993-10-31

- Address : 51432 Schowalter Drives Conroyfurt, CT 83275

- Phone : 872.862.7052

- Company : Ratke LLC

- Job : First-Line Supervisor-Manager of Landscaping, Lawn Service, and Groundskeeping Worker

- Bio : Dolore qui illo dolores aut aut consectetur laboriosam perspiciatis. Quis molestiae aut ratione voluptate delectus ab voluptate. Rerum optio et repudiandae rem. Minus porro ab illo tempore non fugit.

Socials

instagram:

- url : https://instagram.com/charlie.dubuque

- username : charlie.dubuque

- bio : Culpa et soluta velit non vitae animi exercitationem. Sed consequatur dignissimos ratione ut et.

- followers : 1943

- following : 2412

tiktok:

- url : https://tiktok.com/@charlie_real

- username : charlie_real

- bio : Voluptas rerum id et alias.

- followers : 1573

- following : 1381

twitter:

- url : https://twitter.com/charliedubuque

- username : charliedubuque

- bio : Voluptas delectus sed ea at. Officiis consequatur id in rerum rerum. Sint at quis commodi sunt repellat quisquam.

- followers : 4403

- following : 2575